When Are Swap Points Applied at DecodeFX?

At DecodeFX, swap points are calculated at the end of each trading day when positions are held overnight

(based on server time, corresponding to MT4/MT5 platform time).

- FX Currency Pairs: One day’s swap is applied at the New York market close (typically 6:00–7:00 AM JST).

- Triple Swap Wednesday: On Wednesday at rollover time, swaps are applied or deducted for three days (Wednesday, Saturday, and Sunday) combined.

The following table summarizes the standard Triple Swap Day schedule for each product category.

| Product Category | Triple Swap Day | Comments |

|---|---|---|

| FX Currency Pairs | Wednesday | Triple swaps are applied at 7:00 AM (JST) on Thursday morning. |

| Precious Metals CFD | Wednesday | Same as FX — weekend swaps are adjusted on Wednesday. |

| Equity Index CFD | Friday | Triple swaps are credited on Friday to reflect the weekend market closure. |

| Energy CFD | Friday | Triple swaps are applied on Friday to account for crude oil market holidays. |

| Cryptocurrency CFD | Friday | Although weekend trading is not available, swap adjustments occur on Friday. |

💡 The exact swap rate values can be checked in real time on the MT4/MT5 platform under the “Specification” window for each instrument.

✅ なぜ3倍?

Because financial markets are closed during weekends, interest rate adjustments cannot be processed on those days.

Therefore, swap points for Saturday and Sunday are calculated and applied together —

typically on Wednesday (for FX and metals) or Friday (for indices, energy, and crypto CFDs).

Key Features of Swap Points at DecodeFX

At DecodeFX, when you hold FX currency pairs or various CFDs overnight, swap points (also known as rollover interest) are applied depending on your position direction (buy/sell). These are an important factor that directly affects your overall trading costs and potential returns.

Unified Swap Conditions

- Same swap terms apply to all account types – Standard / ECN / VIP

- Provides fair and transparent trading conditions with no account-based differences

Different Rules by Instrument

- FX Pairs / Precious Metals / Energy / Indices / Cryptocurrencies, etc.

- Calculation methods and units vary depending on the product category

Timing of Application

- Automatically applied at each business day’s server close (based on MT4/MT5 time)

- On Wednesdays, Triple Swaps (3 days) are applied to include weekend adjustments

- Some CFDs apply the Triple Swap on Fridays (depending on the product)

| Item | Details |

|---|---|

| Calculation Time | At the close of each trading day (based on MT4/MT5 server time) |

| Triple Swap | FX & Metals: Wednesday / Some CFDs: Friday |

| How to Check | View the “Specification” section for each instrument in MT4/MT5 |

Example Formula for FX Swap Calculation

Swap Amount = Contract Size × Decimal Point × Lot Size × Swap Point

• Lot Size: Number of lots held (e.g., 1.00)

• Contract Size: 1 FX lot = 100,000 units

• Decimal Point: 3-digit pairs (e.g., USDJPY) = 0.001 / 5-digit pairs (e.g., EURUSD) = 0.00001

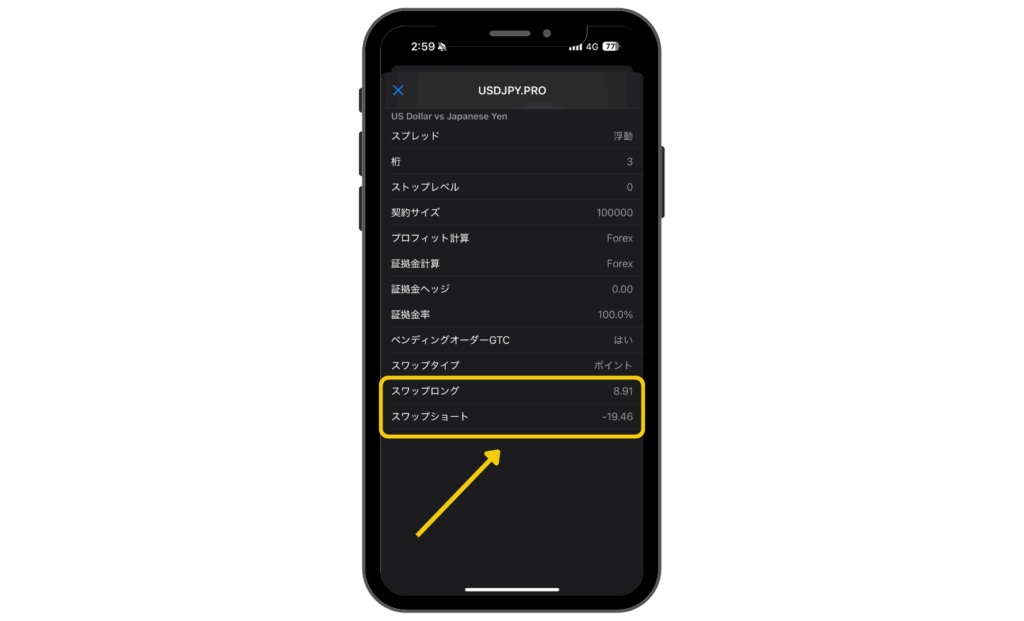

• Swap Point: “Swap long / Swap short” values shown in MT4/MT5Example 1: USDJPY (Buy)

- Lot Size: 1.00

- Contract Size: 100,000 units

- Decimal Point: 0.001 (3 digits)

- Swap long: 15

Calculation 1 × 100,000 × 0.001 × 15 = 1,500

→ You receive 1,500 JPY per day

Example 2: USDCAD (Sell)

- Lot Size: 1.00

- Contract Size: 100,000 units

- Decimal Point: 0.00001 (5 digits)

- Swap short: -9.6

Calculation 1 × 100,000 × 0.00001 × (-9.6) = -9.6

→ You pay 9.6 USD per day

* The above examples are for illustrative purposes only. Actual swap rates vary by instrument, market conditions, and liquidity provider rules. For CFDs (such as indices or cryptocurrencies), swap calculations may differ depending on the underlying asset. Always check the latest values in the “Specification” section within your MT4/MT5 platform before trading.

■Major Currency Pairs

These are the most actively traded pairs in global markets.

They feature tight spreads and high liquidity, allowing both beginners and experienced traders

to trade under stable market conditions.

| Currency Pair | Buy Swap (Swap Long) | Sell Swap (Swap Short) |

| USDJPY | 8.91 | -19.46 |

| EURUSD | -8.22 | 1.66 |

| GBPUSD | -3.38 | -3.44 |

| USDCAD | 2.72 | -9.71 |

| USDCHF | 5.44 | -12.39 |

| AUDUSD | -3.49 | -2.18 |

| NZDUSD | -2.65 | 0.18 |

■Other Currency Pairs

Minor Currency Pairs

| 通貨ペア | 買いスワップ(Swap Long) | 売りスワップ(Swap Short) |

|---|---|---|

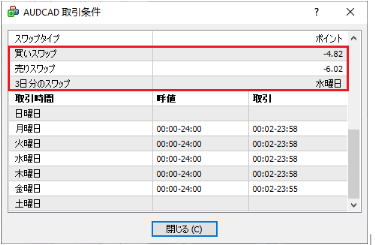

| AUDCAD | -4.82 | -6.02 |

| AUDCHF | 1.9 | -8.86 |

| AUDJPY | 2.54 | -14.46 |

| AUDNZD | -6.65 | -4.88 |

| AUDSGD | -4.04 | -7.78 |

| CADCHF | 1.61 | -9.26 |

| CADJPY | 2.48 | -21.69 |

| CADSGD | -2.93 | -6.95 |

| CHFJPY | -4.93 | -12.32 |

| CHFSGD | -17.92 | 1.28 |

| EURAUD | -12.72 | -3.47 |

| EURCAD | -8.88 | -3.56 |

| EURCHF | 1.88 | -11.49 |

| EURGBP | -8.43 | -0.03 |

| EURJPY | 0.98 | -23.05 |

| EURNZD | -12.78 | 0.98 |

| EURSGD | -11.24 | -6.34 |

| GBPAUD | -4.75 | -11.88 |

| GBPCAD | -4.63 | -16.35 |

| GBPCHF | 4.3 | -22.27 |

| GBPJPY | 6.29 | -37.61 |

| GBPNZD | -9.8 | -13.8 |

| GBPSGD | -4.2 | -17.1 |

| NZDCAD | -1.13 | -5.68 |

| NZDCHF | 0.05 | -8.76 |

| NZDJPY | 1.16 | -16.47 |

| NZDSGD | -1.04 | -7.21 |

| SGDJPY | 1.21 | -18.16 |

Exotic Currency Pairs

| 通貨ペア | 通貨ペア | 通貨ペア |

|---|---|---|

| 買いスワップ(Swap Long) | 買いスワップ(Swap Long) | 買いスワップ(Swap Long) |

| 売りスワップ(Swap Short) | 売りスワップ(Swap Short) | 売りスワップ(Swap Short) |

| USDCNH | USDCNH | USDCNH |

| -51.73 | -51.73 | -51.73 |

| -125.28 | -125.28 | -125.28 |

| USDHKD | USDHKD | USDHKD |

| -20.59 | -20.59 | -20.59 |

| -122.29 | -122.29 | -122.29 |

| EURTRY | EURTRY | EURTRY |

| -7495.76 | -7495.76 | -7495.76 |

| 669.98 | 669.98 | 669.98 |

| EURNOK | EURNOK | EURNOK |

| -100.39 | -100.39 | -100.39 |

| -15.75 | -15.75 | -15.75 |

| EURSEK | EURSEK | EURSEK |

| -31.5 | -31.5 | -31.5 |

| -43.19 | -43.19 | -43.19 |

| GBPNOK | GBPNOK | GBPNOK |

| -39.76 | -39.76 | -39.76 |

| -79.98 | -79.98 | -79.98 |

| USDMXN | USDMXN | USDMXN |

| -513.7 | -513.7 | -513.7 |

| 44.69 | 44.69 | 44.69 |

| USDNOK | USDNOK | USDNOK |

| -20.41 | -20.41 | -20.41 |

| -63.19 | -63.19 | -63.19 |

| USDSEK | USDSEK | USDSEK |

| 0.35 | 0.35 | 0.35 |

| -91.44 | -91.44 | -91.44 |

| USDSGD | USDSGD | USDSGD |

| -0.02 | -0.02 | -0.02 |

| -12.98 | -12.98 | -12.98 |

| USDTRY | USDTRY | USDTRY |

| -6324.63 | -6324.63 | -6324.63 |

| 544.37 | 544.37 | 544.37 |

Precious Metals CFDs

| 銘柄 | 買いスワップ(Swap Long) | 売りスワップ(Swap Short) |

|---|---|---|

| XAUUSD | -39.98 | 18.2 |

| XAUEUR | -22.02 | 5.69 |

| GAUCNH | -40.81 | 1.89 |

| GAUUSD | -156.43 | 95.49 |

| XAGUSD | -52.15 | -0.63 |

| XPDUSD | -26.11 | 2.67 |

| XPTUSD | -21.44 | -50.96 |

Stock Index CFDs (Indices)

| 銘柄 | 買いスワップ(Swap Long) | 売りスワップ(Swap Short) |

|---|---|---|

| AUS200 | -2.34 | -0.38 |

| CNA50 | -3.73 | -1.48 |

| DAX40 | -5.23 | -2.3 |

| DOWJ30 | -12.23 | -1.44 |

| EUSTX50 | -1.36 | -0.51 |

| FTSE100 | -2.57 | -0.32 |

| HK50 | -3.96 | -3.18 |

| JP225 | -64.77 | -53.98 |

| NAS100 | -5.94 | -0.72 |

| SPX500 | -1.67 | -0.2 |

Energy CFDs

| 銘柄 | 買いスワップ(Swap Long) | 売りスワップ(Swap Short) |

|---|---|---|

| USOIL | 1.67 | -24.52 |

| UKOIL | 1.52 | -31.07 |

Cryptocurrency CFDs

| 銘柄 | 買いスワップ(Swap Long) | 売りスワップ(Swap Short) |

|---|---|---|

| BTCUSD | -10 | -10 |

| ETHUSD | -15 | -15 |

| LTCUSD | -15 | -15 |

| XRPUSD | -15 | -15 |

| DOGEUSD | -15 | -15 |

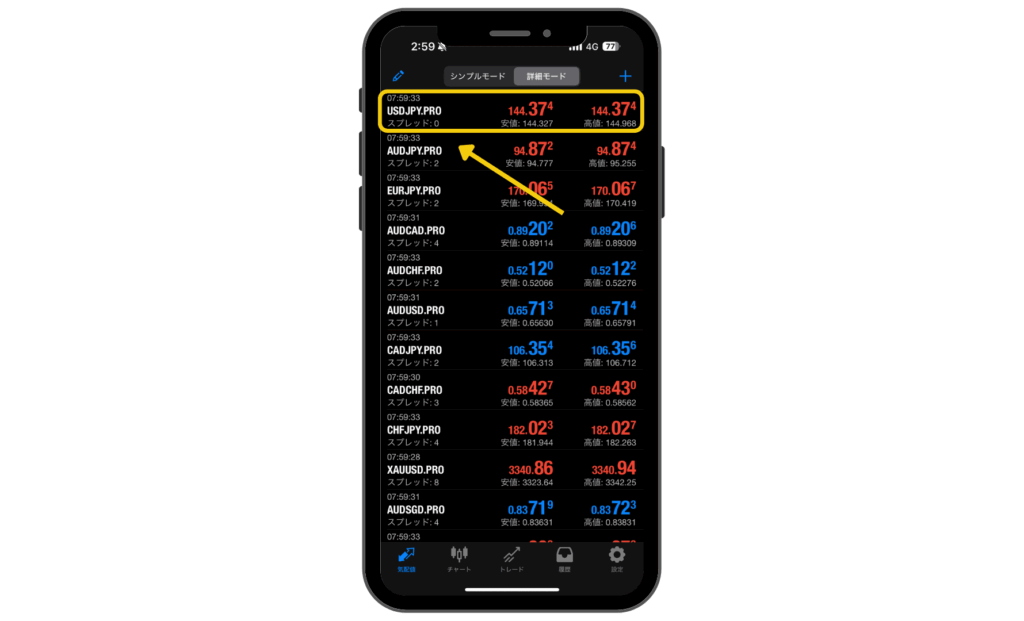

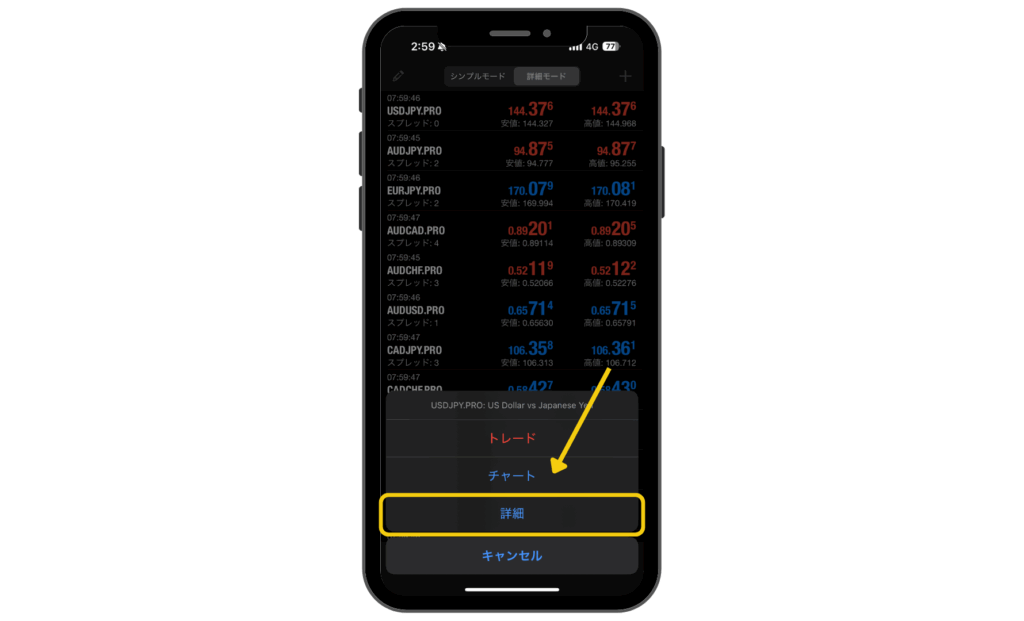

How to Check Swap Points for Each Instrument

At DecodeFX, you can easily check the swap points for each instrument directly within the trading platforms MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

The following explains how to check swap points on both the PC version and mobile app version of the platform.

■ Checking on PC (Windows / Mac)

■ Checking on Mobile (iOS / Android)

💬 If you cannot check swap points:

If you are unable to perform these operations on the client portal or if real-time swap values are not displayed,

please contact DecodeFX Customer Support (Japanese support available) at:

📩 jpsupport@decodefx.com

In DecodeFX trading, swap points directly affect your trading strategy and account balance. Please keep the following points in mind.

1. Swap points fluctuate daily

Swap points are not fixed. They change daily based on factors such as each country’s monetary policy, movements in the interbank market, and overall market liquidity. The amount may differ from one day to the next, even for the same instrument.

- Changes in national interest rate policies (rate hikes or cuts)

- Currency supply and demand, and market volatility

- Fluctuations in interbank funding rates

👉 Be aware that the direction of payment and receipt may sometimes reverse.

2. Greater impact on long-term positions

When holding positions for several days or weeks, accumulated swap values can significantly affect your realized profit and loss. Negative swaps (payments) may reduce unrealized gains over time.

3. Pay attention to triple swaps

A “triple swap” adjustment is applied to cover two non-trading days over the weekend.

- FX pairs / Precious Metals CFDs: 3 days’ worth applied at Wednesday’s server close

- Stock Index / Energy / Cryptocurrency CFDs: 3 days’ worth applied on Friday

👉 Unexpected fluctuations in profit or loss may occur during these periods.

4. Some instruments have higher swap rates

Exotic FX pairs and Cryptocurrency CFDs tend to have higher swap costs due to market volatility and funding rates. While suitable for short-term trading, caution is advised for long-term holding.